Australian Tax Office Superannuation Contribution Limits

.png)

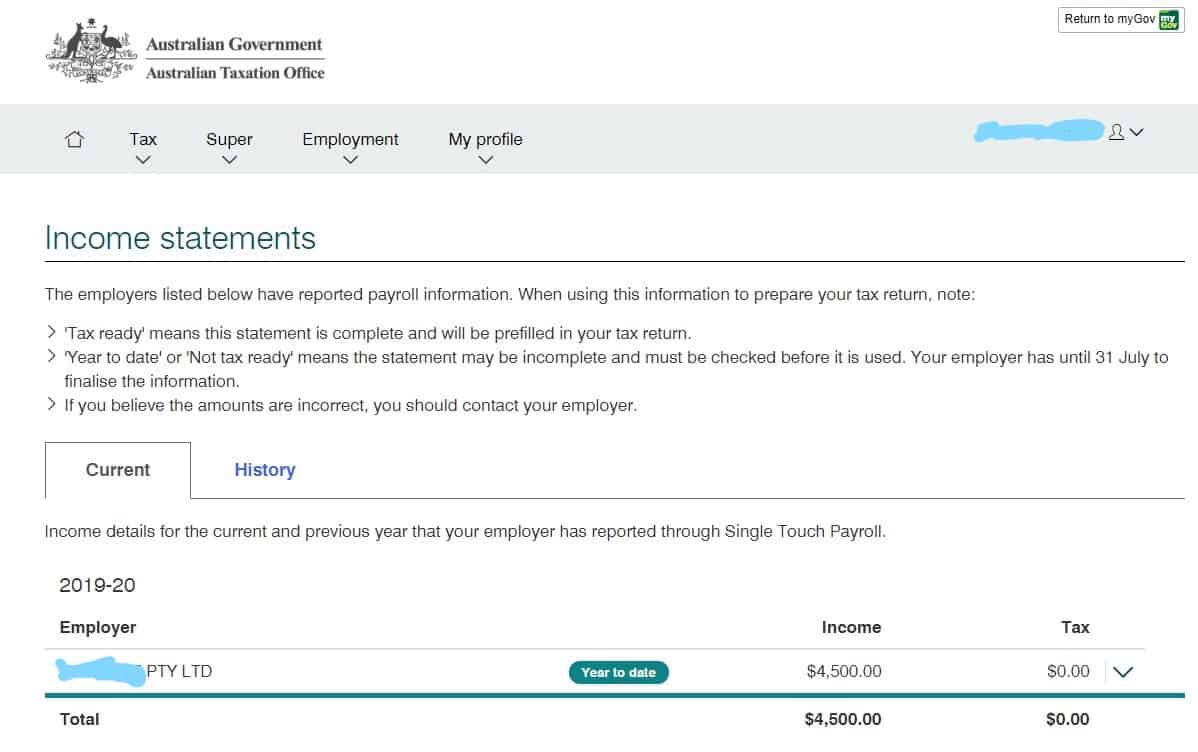

For most people super begins when you start work and your employer starts paying a portion of your salary or wages into a super fund for you.

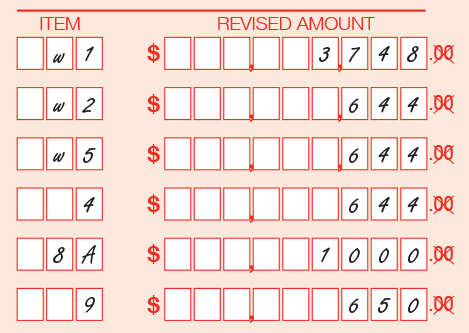

Australian tax office superannuation contribution limits. High call volumes may result in long wait times. Super or superannuation is money set aside during your working life for when you retire. From the 2018 19 year unused concessional contribution limit can be carried forward for a maximum of 5 years provided the total superannuation balance is under 500 000. Therefore the first year these unused amounts can be used will be in the 2019 20 year.

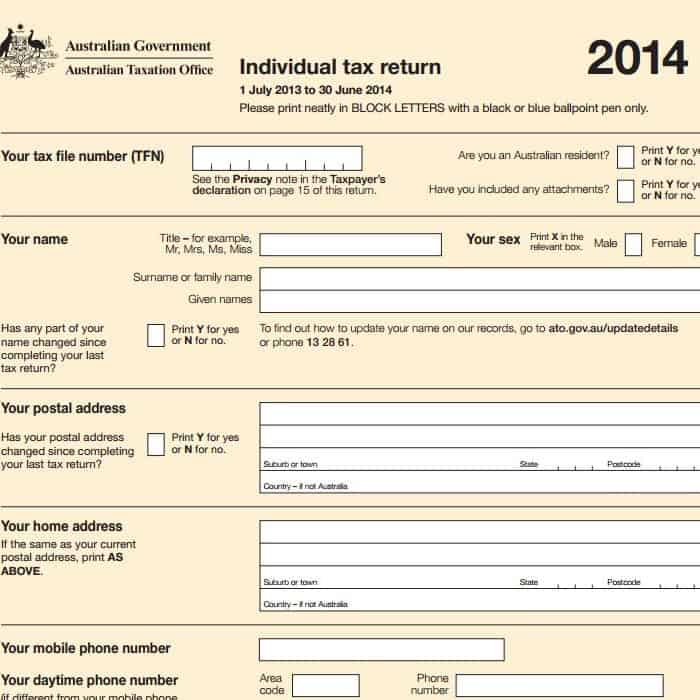

Changes came into effect in 2017 18 where now no matter your age you can contribute up to 25 000 per year into your superannuation at the concessional rate including. These payments are known as super guarantee contributions or concessional pre tax contributions. From 1 july 2017 the non concessional contributions cap is reduced to 100 000 for members 65 or over but under 75. You can only make after tax contributions to your apss account if we have your tax file number tfn.

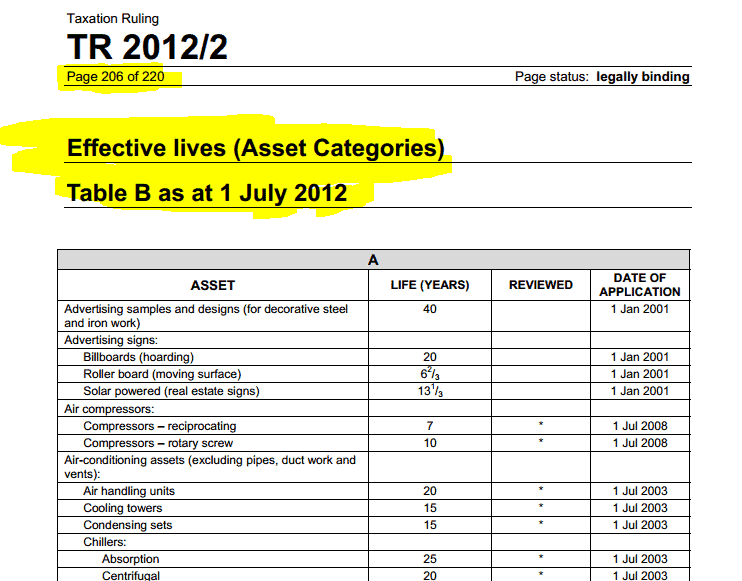

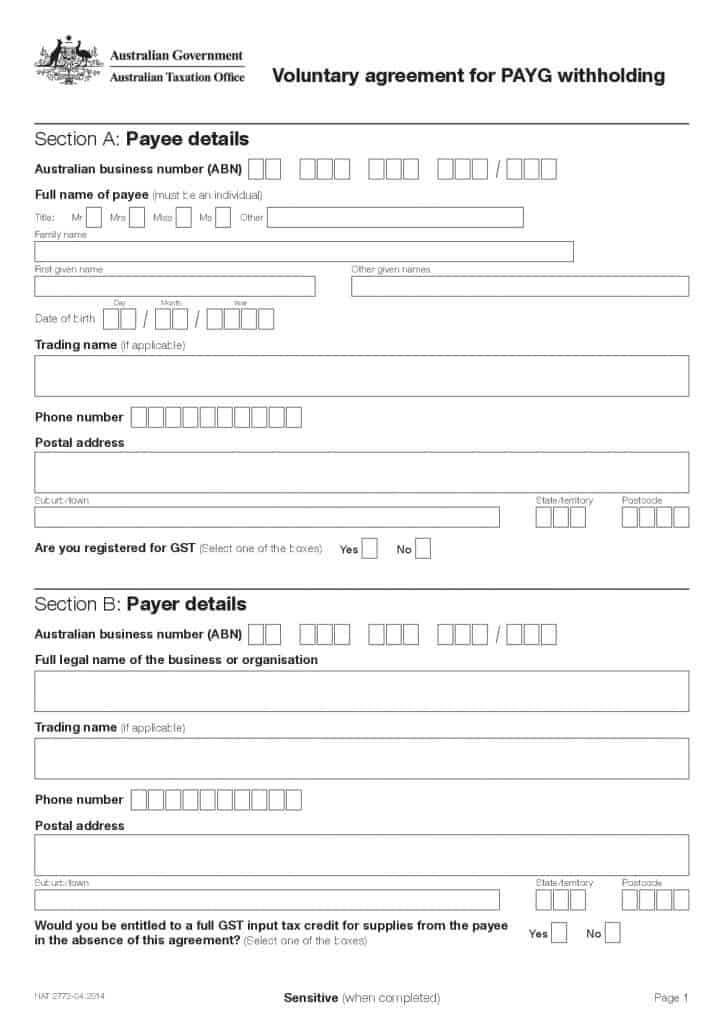

Caps apply to contributions made to your super in a financial year. If you would like to provide the apss with your tfn just complete and return the provide your tax file number opens in new window form. You can also provide your tfn by calling superphone on 1300 360 373. Before calling us visit covid 19 tax time essentials or find answers to our top call centre questions.

From 1 july 2017 this threshold is being reduced to 250 000. Personal contributions are non concessional or after tax contributions unless you have claimed a tax deduction for them. They re taxed at a rate of 15 if you earn less than 250 000 a year and 30 if you earn more than 250 000 a year. Division 293 tax is 15 of your taxable concessional contributions above the 250 000 threshold.

If you contribute more than these caps you may have to pay extra tax. Division 293 tax is an additional tax on super contributions if your combined income and super contributions are more than the threshold.